Establishing Your Credit

0%

A good credit score affects almost every single financial activity or decision you are going to take in Canada.

Canada Drives

Among the important things you will think about as a newcomer to Canada, building a good credit score is a major factor in facilitating your life. As a newcomer, you must first establish your credit and build your credit history. After that, you will aim to improve it. A good credit score affects almost every financial activity or decision you will take in Canada, such as borrowing money, renting a house, and even whether an employer will give you the job. This article will first provide a brief intro to what a credit score is in Canada. Then, steps for establishing your credit score and tips for improving it are presented.

What is a Credit report and a Credit Score?

Your credit report summarizes your credit history, created when you first applied for your credit and borrowed money. The lenders will forward information regarding your credit and account to credit bureaus and agencies to highlight how well you manage credit and how big the risk of lending you money is.

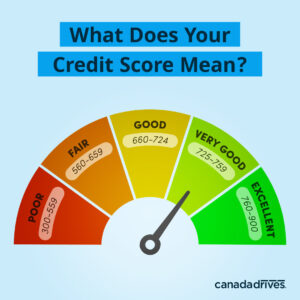

Your credit score is a three-digit number calculated using a formula based on the information you have in your credit report. The credit score will be around 300 if you are just getting started with building it, 650 being the average middle number qualifying you for standard loans, and 900 being the highest score your credit could attain. The figure below from Canada Drives provides a comprehensive meaning of your credit score.

The higher your credit score is, the better opportunity you have to borrow money and get a mortgage and subsequently, the lower the interest rates you pay. Useful information on credit scores and reports can be found here.

What are the main factors affecting your credit?

Below is a list of the main factors that may affect your credit score:

• How long you have had credit

• How long each credit has been in your report

• The balance on different credit cards

• Missing payments and deadlines

• Outstanding debts

• Your score compared to your credit limit

• Number of credit applications

• Credit type

• Debts reported to collection agency

• Insolvency or bankruptcy record

Tips to Build a Good Credit Score

Building up and improving your credit score takes time. The five tips below are recommendations by the Canadian government to build a good credit score, which is very useful, especially if you are a newcomer starting from scratch.

1. Monitor your Payment History

The key pillar in building and improving a good credit score is to monitor your payments and enhance your payment history. In this regard, these are recommendations for improving your credit score:

• Make payments on time

• Making minimum payments instead of no payments in case you face financial troubles

• Keep in contact with your lender in case you have troubles

• Don’t skip payments and deadlines

2. Use Credit Wisely

It is all about wisely managing your credit. So, try to avoid exceeding your credit limit. Also, respect the limits on your credit cards and try not to go over them, as borrowing money more than the set limit on the credit card will lead to lowering your credit score. The recommendation is to use less than 35% of your available credit limit.

3. Increase your Credit History Length

As a newcomer to Canada, you will have no credit history. But as you establish your credit and keep building it, you will also enhance your credit history. The longer you have a credit account open and in use, the better it is for your score. Newer accounts will lead to low credit scores, so keep an older account open even if you don’t need it or use it regularly.

4. Limit Credit Applications and Checks

Some advice is to limit the times you apply for credit and only apply when needed. Understandably, you are going to apply for credit from time to time; however, every time you do that, the lenders will ask the credit bureau for your credit report, which is known as an inquiry or credit check. Too many checks on your credit will give the impression that you have credit mismanagement and increase the risks of lending you money.

5. Use Different Credit Types

If you only have one credit product, such as a credit card, this might lower your credit. Try to increase your credit products and mix between them, including credit cards, car loans, and lines of credit. Such a mix will enhance your credit history and score. However, keep an eye on your budget and ensure you can pay bills for various products on time and avoid debt.

Here, you can find information on how to order a free credit report. In addition, if you need help from a credit counsellor, please visit this debt help page to know your options.

You can also download the free financial app Expedier, which helps mitigate financial barriers immigrants to Canada face through BIPOC-focused global banking.

Tags: credit, credit score, credit report, money, loan, mortgage, lenders, finance, debts, payments, credit cards, credit limit

RELATED ARTICLES

Recent Posts

- 2SLGBTQI+ Resources

- Local Immigration Partnership Renfrew and Lanark Counties launch online survey

- CULTURE CONNECT: Local Immigration Partnership and United Way East Ontario secure funding for New Horizons Program

- Pathways – Immigration to Canada

- Almonte resident George Yaremchuk presented with Culture Connector Award

Tags

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Recent Comments