Guide to your Social Insurance Number (SIN)

0%

In addition to needing a Social Insurance Number for employment in Canada, the Social Insurance Number in Canada is used for filing personal taxes and obtaining benefits.

LIP

What is a Social Insurance Number (SIN)?

A Social Insurance Number (SIN) is a nine-digit identification used by government agencies. Getting a SIN is one of the first tasks you’ll need to complete after arriving in Canada. You need a SIN to legally work. When you start a job, you must provide your SIN to your employer, and employers must ensure workers have a valid SIN. You also need a SIN to file taxes, access government programs, and receive benefits such as Employment Insurance (EI) and the Canada Pension Plan (CPP). The purpose of a Canadian SIN is similar to the National Insurance Number in the UK, the Tax File Number in Australia, the Social Security Number in the USA, and the PPS number in Ireland.

Eligibility

Canadian citizens, permanent residents, and temporary residents aged 12 or older can apply for their own SIN, while parents can apply on behalf of their children.

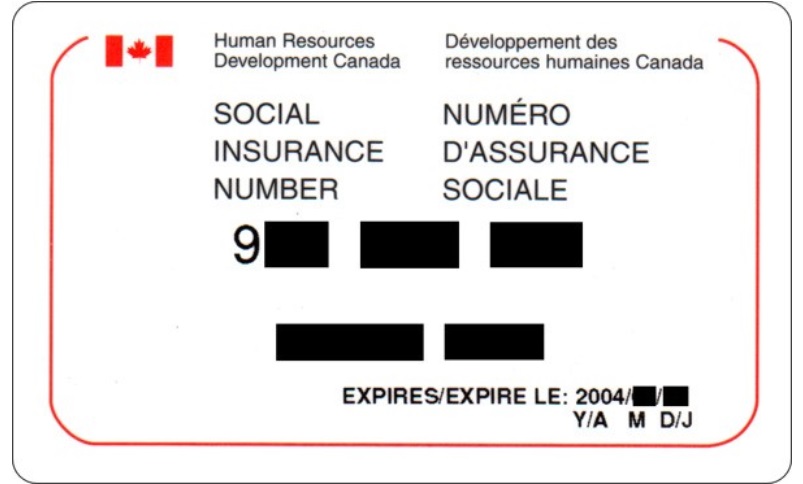

900 Series SIN

Temporary residents receive a SIN that begins with “9.” These are called 900-series Social Insurance Numbers and are temporary, unlike SINs issued to Canadian citizens or permanent residents.

How to Apply

You can request a SIN by gathering your documents and applying in person, online, or by mail, and there is no fee to apply.

Required documents

- Primary identity document - includes birth certificate, certificate of Canadian Citizenship, PR card, work permit, student permit, certificate of Indian Status.

- Secondary document - includes a passport (Canadian or foreign), a Canadian driver’s license, or a Canadian-issued ID.

If you are applying on behalf of your child, you should bring both your documents and your child’s. Click here for a complete list.

Applying in-person

The quickest way to get a SIN is by applying in person. Visit a Service Canada location near you and bring original copies of your documents. You will receive your SIN at the end of the visit, and your original documents will be returned to you. You can find your nearest Service Canada office here.

Applying online

You may also apply online through the Service Canada portal. In this case, you can submit digital copies of your documents. It may take 10 business days to receive a response.

Applying by mail

If you are applying by mail, you will have to send your original documents and a completed application form to the following address:

Service Canada

Social Insurance Registration Office

PO Box 7000

Bathurst NB E2A 4T1

Canada

Service Canada is not responsible for any loss of documents. You will receive your SIN and original documents within 20 business days from the day the application is received.

Protecting your SIN

Your SIN should remain confidential. Someone with your SIN could use it illegally to access your private information. It is important to only reveal your SIN when necessary. If your SIN is stolen, another person could claim your government benefits, tax refunds, and more.

In most cases, you will be asked for your SIN for employment at the time of hiring, for filing income taxes, for financial transactions where you earn interest or income, and for dealings with the government. Therefore, do not give out your SIN unless you are absolutely sure the request is from a valid employer, a reputable organization, or an official government agency.

- When you receive your Confirmation of SIN letter, store it in a safe place. (Service Canada no longer issues plastic SIN cards).

- Never carry your SIN the way you would a driver’s license.

Updating your SIN

You may need to update your SIN in certain situations.

People with temporary status in Canada, such as international students or foreign workers, receive a 900-series SIN that expires on the date shown on their immigration document. If you renew your student or work permit, you must also update your SIN.

If you entered Canada as a temporary resident and later obtained permanent residence, you must apply for a new SIN, which will not start with a 9.

People who change their legal name must inform Service Canada of this change. Those who wish to modify their gender designation on their documents may also update their SIN.

For more information on the Social Insurance Number and the application process, please contact the Social Insurance Number Program.